We help modernization leaders uncover hidden value and make data-driven decisions 10x faster with AI Workers 🤖.

Our Anthropomorphic Virtual Workers leverage advanced AI to uncover hidden use cases, estimate efforts precisely, and empower data-driven decisions for smoother modernization.

Get Started

The Burden of Legacy Systems ⚓

Bonnie Green

Payments Business Analyst, ShowFlow AI

Financial institutions have depended on legacy systems for decades - outdated software that was state-of-the-art when implemented. 👴

While these systems were workhorses in their heyday, the rapidly evolving financial landscape has rendered them inadequate to meet modern demands. 🏃♀️

Maintaining and updating such antiquated systems is a mounting challenge that drains resources and impedes innovation. 🧭

#LegacySystems #TechDebt #Modernization

Legacy Baggage

The Numbers Weighing Banks Down

Banks outdated systems restrict their ability to launch new payment apps. This stunts the growth of the digital payments market, which remains limited in size.

- £57B

- Banks will spend on legacy payments technology in 2028

- 18%

- New digital products developed by banks this year.

- 7%

- Of the $120 trillion B2B payment volume is conducted digitally.

Is Your Technology Holding You Back? 🕰️

Take This Quick Poll to Find Out!

The Promise of Modernization 🚀

Helene Engels

Payments Business Analyst, ShowFlow AI

🚨 Forward-thinking financial institutions are recognizing the challenges of #LegacySystems and embarking on a #Modernization journey. 🚀

By migrating to modern, #CloudBased systems, they unlock numerous benefits, including increased efficiency, scalability, and security. ⚡️💻🔒

However, the #ModernizationProcess is complex and fraught with risks, requiring a deep understanding of the intricate workings of legacy systems. 🧩🔎

The Roadblock to Banking Modernization

Insights from Financial Institutions Grappling with Outdated Core Infrastructures

Modernizing the core banking system enabling the future

"Wipro highlights the difficulties faced by banks in modernizing their core banking systems due to legacy platforms that are challenging and expensive to maintain, lacking flexibility for digital experiences, and not designed for emergent regulatory initiatives like open banking.

The solution for this new era is multifaceted, but a key strategic element is to modernize the core banking system.

If you care for your time, I hands down would go with this."

For decades, RBS failed to invest properly in its systems

"The Royal Bank of Scotland experienced a system crash after an upgrade went wrong, costing the bank millions in compensation and damaging its reputation. This incident highlights the risks associated with outdated legacy systems and the challenges of updating them.

They need to do more, they need to allocate a greater portion of their spend to IT."

The biggest threat to banks? Legacy systems, not fintech

"I expresse concerns about the threat of legacy systems to the digital transformation of big banks, emphasizing the complexity and risks associated with transitioning from outdated systems.

Most bankers (83%) recognize the importance of digital transformation, but only 43% of bank executives are committed to transforming..."

The Challenges of Core Transformation

"Despite significant advancements in technology, many of the largest banks continue to rely on aging legacy core systems that date back to the 1970s and 1980s. These systems, often built on mainframe technology, have been the backbone of banking operations for decades.

This situation highlights a key paradox in the banking industry: the need for technological evolution while grappling with the inertia of legacy systems."

Unlock Your Future with Legacy System Modernization 🔑

Tired of outdated tech holding you back? 🐢

Break free with our legacy system modernization services.

Our experts will assess and modernize your core systems, ensuring a seamless transition to an efficient, scalable, and secure future. 🚀🔒

Don't let legacy systems stifle growth and innovation.

Introducing the AI Assistant 🤖

Payments Business Analyst, ShowFlow AI

🔍 To navigate the complexities of #LegacyModernization, financial institutions can now leverage the power of #ArtificialIntelligence. 🤖

Introducing the Anthropomorphic Virtual Worker 🤖, an #AIAssistant designed to aid modernization managers on their journey. 🧭

This advanced system interacts via chat 💬, accessing documentation, databases, and log files to build a comprehensive model of your legacy systems. 📂🗄️

Modernizing 1,000+ Legacy Apps?

AI Assistants Lead the Way.

Large global banks typically have over 1,000 software applications running worldwide operations. Without AI assistance, modernizing this massive suite of legacy systems would be an overwhelming task. Anthropomorphic Virtual Workers model and navigate these complex applications, enabling a smoother digital transformation.

An AI that Speaks Your Language

1️⃣ The Anthropomorphic Virtual Workers hold unique digital identities stored securely on the blockchain, similar to human IDs.

2️⃣ Each AI Worker is represented by a distinct token, ensuring their individuality and authenticity.

3️⃣ At the core of every AI Worker is an initial system setup, reflecting human-like behaviors and capabilities.

4️⃣ The fundamental configuration of the system is permanently recorded on the blockchain, ensuring it cannot be modified, while still maintaining transparency about its details.

5️⃣ When an AI Worker is transferred to a new owner, the existing system setup can be expanded by adding new human-like behaviors and capabilities.

6️⃣ Each AI Worker is trained using private data from the projects it has worked on, allowing it to accumulate knowledge and become a expert model over time.

7️⃣ Just like human experience, the AI Worker expand their skills and expertise through the projects they are fine-tuned for, becoming increasingly valuable to their owners.

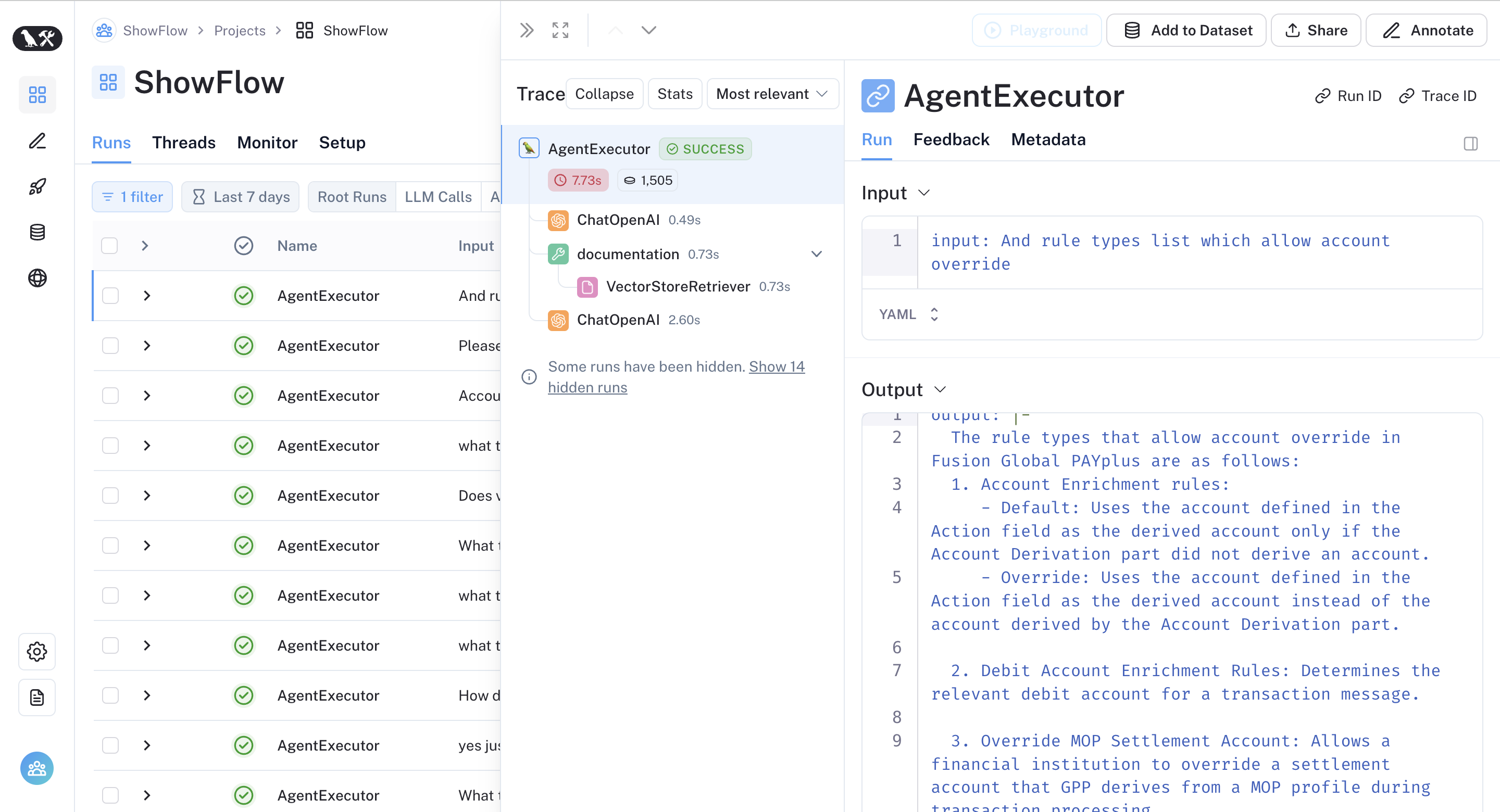

Building Trust through Transparency 🔎

Michael Gough

Payments Business Analyst, ShowFlow AI

🔐 Trust is paramount when dealing with sensitive #FinancialData and mission-critical systems.

The #AIAssistant establishes trust by offering complete transparency into its decision-making processes. 🔎

Users can access detailed explanations and proofs for the AI's recommendations, ensuring every step is understood and validated. ✅💯

Understanding Complex Tech Systems Is Difficult and Expensive

Traditionally, teams spend huge amounts of money and wait for very long periods (sometimes years) just to properly understand their intricate technology infrastructures well enough to build new capabilities on top of existing systems. ShowFlow AI takes away the complexity by simplifying the approach without compromising the results.

Technologies

Fueled by large language models, ShowFlow AI extracts actionable use cases by analyzing system inputs and outputs - reverse engineering critical workflows without diving into underlying legacy tech complexities.

Platforms

Uncovers use cases across platforms through code-agnostic analysis of system outputs. Our algorithms work seamlessly across languages, technologies, and infrastructure configurations.

Implementations

Analyzes the outputs and artifacts of your legacy systems like logs, messages, and databases - not the internal code. Our algorithms disregard how business rules and processes are technically implemented within application code.

Architectures

Our algorithms reconstruct end-to-end workflows across legacy systems and architectures by analyzing artifacts. Technical implementation details are irrelevant.

Data schemas

Reverse engineers business processes and rules, not data models. We discover use cases behind the logic encoded in legacy systems, not the underlying data schemas and structures.

Operations

Keep your companys lights on with customizable, iterative, and structured workflows built for all efficient teams and AI Assistants.

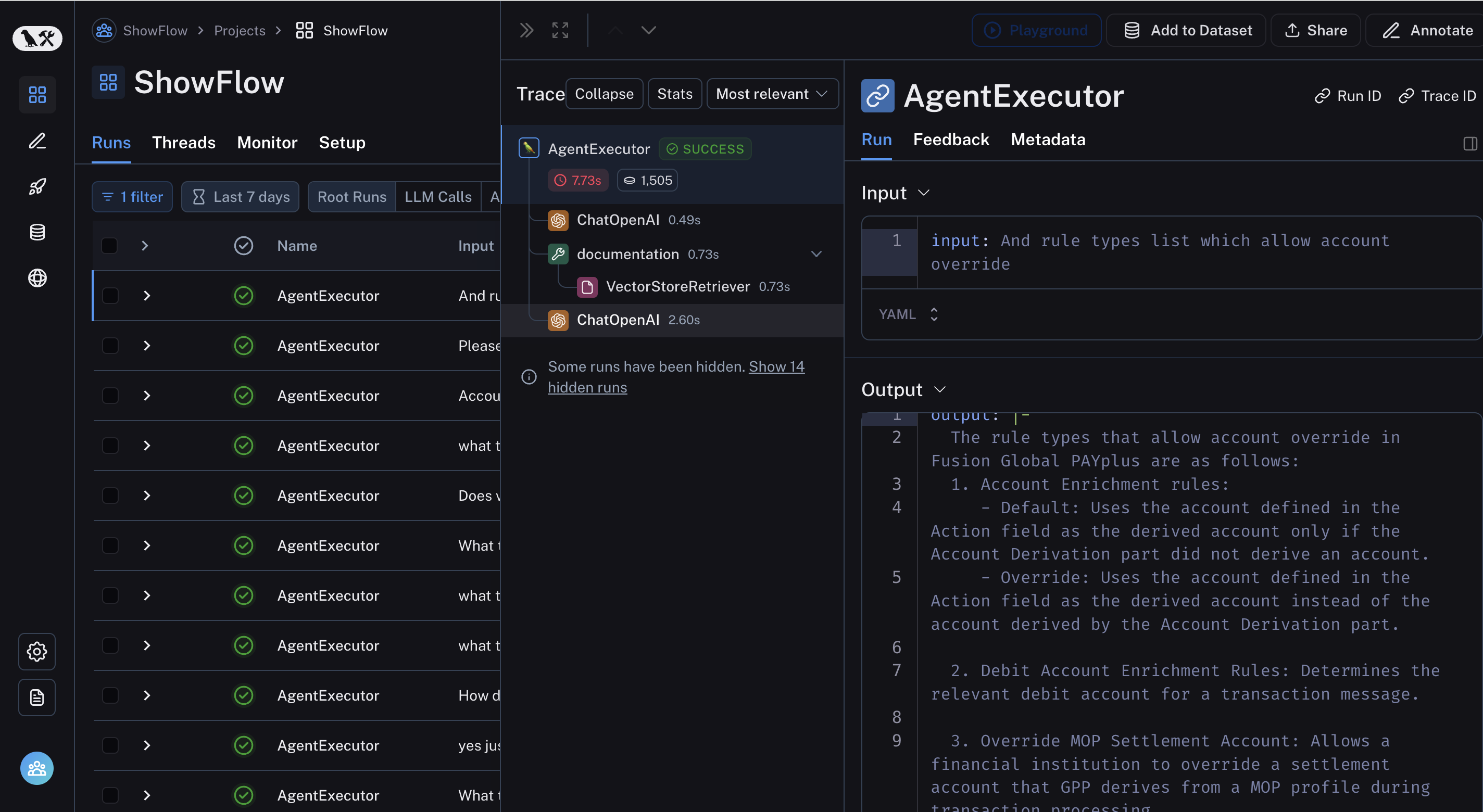

Transparent and Trusted Technology

Our Anthropomorphic Virtual Workers are built on a robust technology stack, including LangChain, LangSmith, Graph/Vector Databases, and CrewAI. This ensures seamless LLM management, real-time monitoring, structured data storage, and dynamic conversational abilities - all underpinned by a commitment to transparency and reliable performance.

Get startedTaking Action with the AI Team 👥

Leslie Livingston

Payments Business Analyst, ShowFlow AI

🚩 Recognizing the value and potential of the #AIAssistant , an innovative team of #AI experts has assembled a cohort of these virtual workers. 💻👩💻

Each #AIWorker specializes in different aspects of #LegacyModernization . 🧑🔬🔍

This #AITeam is now available for hire, offering financial institutions a comprehensive and scalable solution to tackle modernization challenges. 🏦🚀

Meet AI Team

Elevate your product development with our cutting-edge AI Workers. Harness the power of AI for unparalleled efficiency and innovation.

Bonnie Green

AI Product Owner

Helene Engels

AI Product Team Lead

Jese Leos

AI Product Owner

Lana Byrd

AI Product Owner

Joseph Mcfall

AI Product Team Lead

Leslie Livingston

AI Product Owner

Michael Gough

AI Product Owner

Neil Sims

AI Product Owner

Identity profile

Identity profile